food tax jefferson parish

Jefferson Parish has a lower sales tax than 61 of Louisianas other cities and counties. In addition to the sales tax levied on the furnishing of rooms by hotels motels and tourist camps an occupancy tax is imposed on the paid occupancy of hotelmotel rooms located in the Parish of Jefferson.

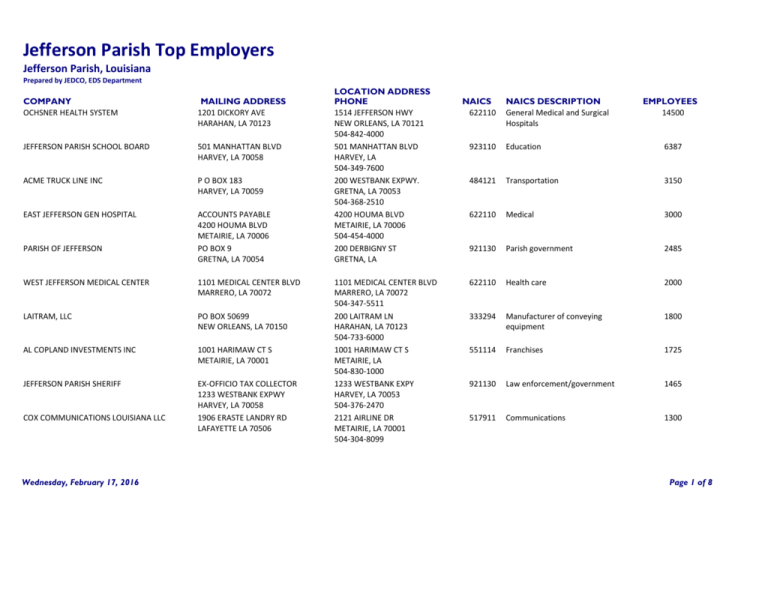

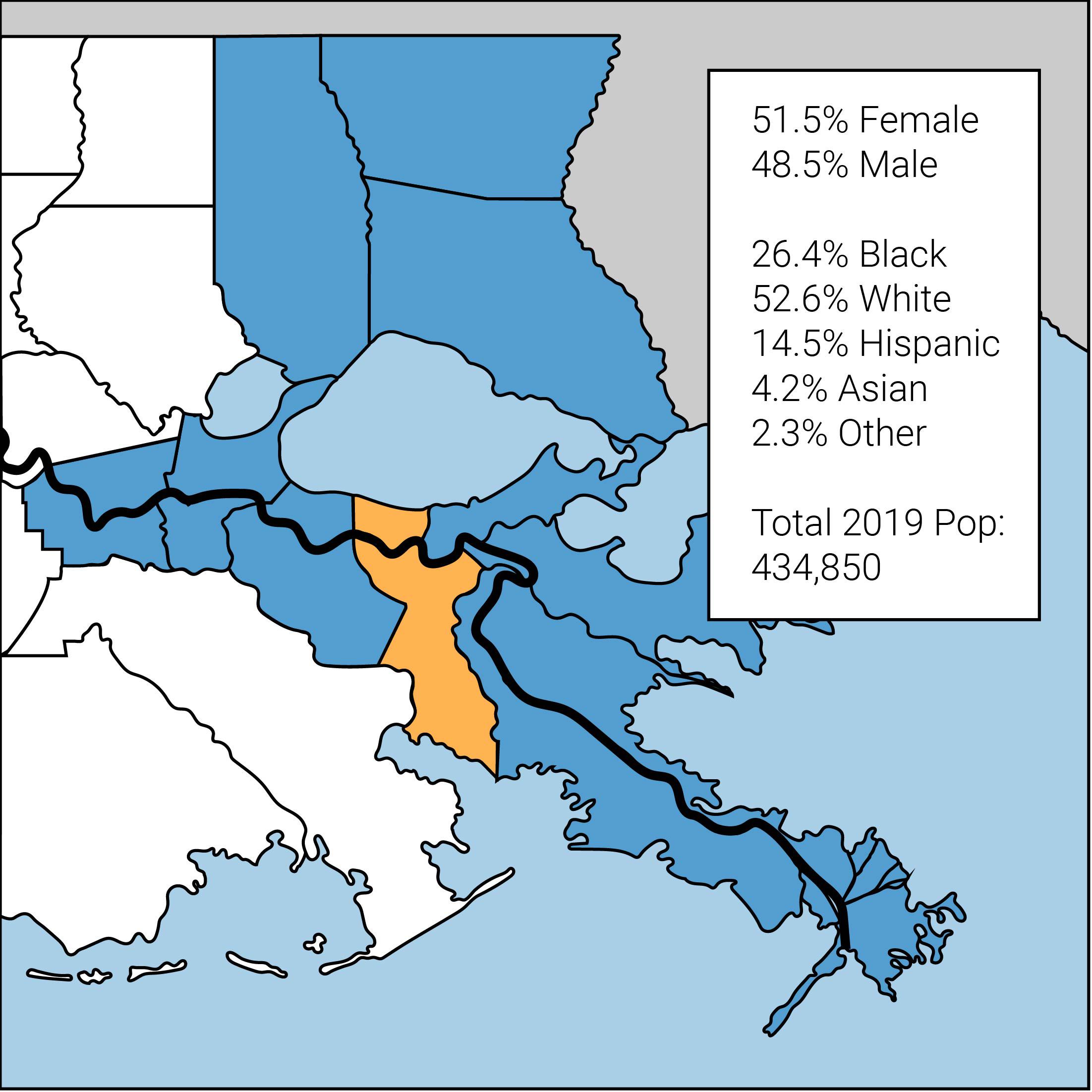

Jefferson Parish Top Employers

There is 1 Food Stamp Office per 218519 people and 1 Food Stamp Office per 147 square miles.

. 35 on the sale of prescription drugs and medical devices prescribed by a physician. Our office is open for business from 830 am. Get access to thousands of forms.

Tax Break due to High Gas and Fuel Prices. Tion franchise and withholding taxes. 350 The following local sales tax rates apply in Jefferson Parish.

475 on the sale of general merchandise and certain services. The preliminary roll is subject to change. 475 on the sale of general merchandise and certain services.

The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. Jefferson Parish collects a 475 local sales tax the maximum local sales tax allowed under Louisiana law. The Jefferson Parish Schools Food Services Department is responsible for preparing and serving meals offered to students and staff throughout the district.

Groceries are exempt from the Jefferson Parish and Louisiana state sales taxes. Use professional pre-built templates to fill in and sign documents online faster. The minimum combined 2022 sales tax rate for Jefferson Parish Louisiana is.

The Louisiana state sales tax rate is currently. You can find the SalesUse Tax Registration form there. What is the food tax in Jefferson Parish.

A convenience fee of 249 is assessed for. Audits are assigned at random upon review of taxpayer returns and upon information received from other taxing jurisdictions local state and federal. The Jefferson Parish Sales Tax is 475.

Questions or comments concerning the state sales tax exemption for food products can be directed to the Department of Revenues Taxpayer Services Division in Baton Rouge at 2252197356 or to one of the departments Regional Service. Jefferson parish collects a 475 local sales tax the maximum local sales tax allowed under louisiana law. Due to the Annual Tax Sale this site can only be used to view andor order a tax research certificate.

Students are offered a variety of healthy meals daily. Menus are planned following United States Department of Agriculture USDA guidelines with an emphasis. This is a Petition to start a Tax Break on Food in Jefferson Parish.

A county-wide sales tax rate of 475 is applicable to localities in Jefferson Parish in addition to the 445 Louisiana sales tax. The following are services provided to Jefferson Parish citizens during this time. 350 -Food Prescription Drug items.

Whether you are presently living here only contemplating taking up residence in Jefferson Parish or planning on investing in its property find out how municipal property taxes work. Online Property Tax System. Once the preliminary roll has been approved by the Louisiana Tax Commission the 2020 assessments will be updated on the website.

375 - Hotel Motel room rentals. The 2018 United States Supreme Court decision in South Dakota v. This is the total of state and parish sales tax rates.

In addition this department collects annual sewer fees. Prospective restaurant nightclub or lounge owners should also contact their parish or municipal taxing authorities for information concerning local sales tax occupational license and other requirements. 350 on the sale of food items purchased for preparation and consumption in the home.

Payments are processed immediately but may not be reflected for up to 5 business days. There are 2 Food Stamp Offices in Jefferson Parish Louisiana serving a population of 437038 people in an area of 296 square miles. Some cities and local governments in Jefferson Parish collect additional local sales taxes which can be as high as 2.

In addition to sales tax food and beverage establishments in the City of New Orleans. The Jefferson Parish sales tax rate is. Breakfast and lunch are offered in all schools.

Township of Jefferson 1033 Weldon Road Lake Hopatcong NJ 07849 Phone. 350 on the sale of food items purchased for preparation and consumption in the home 350 on the sale of prescription drugs and medical devices prescribed by a. You may call or visit at one of our locations listed below.

Food Tax Break for JP Citizens. Please be advised the 2021 preliminary roll has been uploaded to the Jefferson Parish Assessor website. Jefferson Parish collects on average 043 of a propertys assessed fair market value as property tax.

For information on taxes or sewer billings please contact the Tax Collection Office at 732 562-2331. The jefferson parish sales tax is 475. Please contact the Jefferson Parish Sheriff 504-363-5710 for payment options.

The Tax Collectors office is responsible for collecting taxes for the Township of Piscataway Middlesex County the Piscataway School Board and the Piscataway fire districts. 1855 Ames Blvd Suite A. This Petition States that the.

With this guide you can learn useful information about Jefferson Parish property taxes and get a better understanding of what to anticipate when you have to pay. A separate tax return is used to report these sales. The Tax Collector is responsible for the collection of real estate taxes collection of assessment for local improvements official searches for municipal liens and collection of other municipal charges.

The link below will take you to the Jefferson Parish Sheriffs office Forms and Tables page of their Web site. Questions or comments concerning the state sales tax exemption for food products can be directed to the Department of Revenues Taxpayer Services Division in. This is the total of state and parish sales tax rates.

200 Derbigny St Suite 1100 Gretna LA 70053. 2-1-1 If you need assistance finding food paying housing bills accessing free childcare or other essential services during this time dial 2-1-1 to speak to someone who can help. There is 1 Food Stamp Office per 218519 people and 1 Food Stamp Office per 147 square miles.

The Jefferson Parish Audit Section focuses on ensuring taxpayer compliance with local tax ordinances and the discovery of unreported or underreported tax revenues.

Cha Ching And Thangs Superdome Construction 1971 75 New Orleans History New Orleans Superdome Louisiana History

Jefferson Parish Property Taxes Are Set For 2018 Local Politics Nola Com

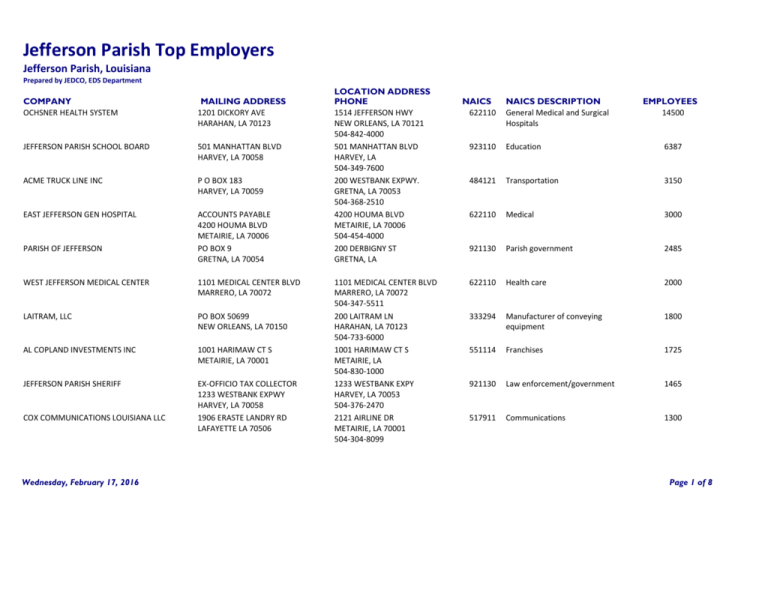

To Help With Fairfield Development Near Avondale Jefferson Parish Hires Consultant Local Politics Nola Com

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com

What Jp Residents Need To Know To Pay Property Tax

Gno Bridge New Orleans History New Orleans Louisiana Crescent City

Louisiana Sales Tax Rates By County

Faqs Jefferson Parish Sheriff S Office La Civicengage

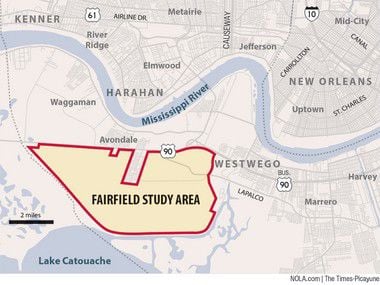

Stability Today Jefferson Parish United Way Of Southeast Louisiana Prosperity Dashboard

Jefferson Parish Looks For Developers To Help Revitalize Fat City New Orleans Citybusiness

Is Food Taxable In Louisiana Taxjar

St Tammany Parish Residents Angry Over Fracking Proposal Local Politics Nola Com

Canal St 1966 The Old Jung Hotel New Orleans History New Orleans New York Skyline

Louisiana New Orleans Trade Mart September 1972 New Orleans New Orleans Louisiana New Orleans History

Louisiana How Do I Add My State Sales Tax Return To My Parish E File Account Taxjar Support

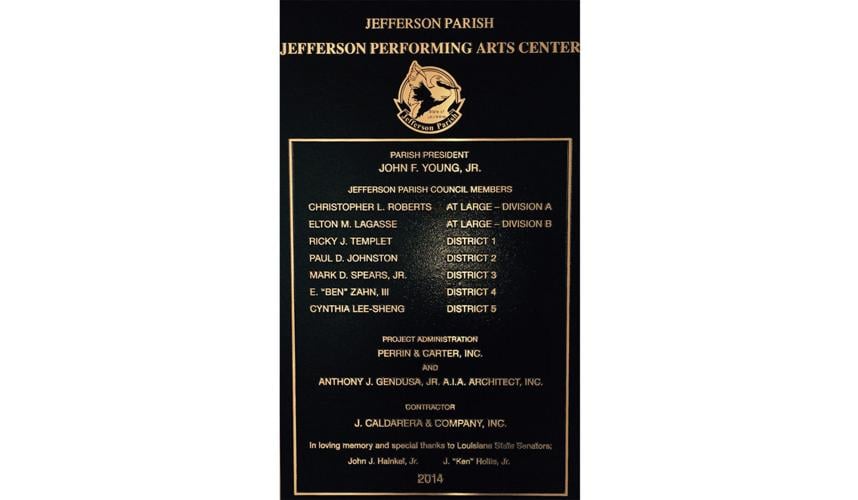

What Do You Think Jefferson Arts Center Plaque Should Say Local Politics Nola Com

A Celebration Of Hope Holiday Event In Jefferson Feeds Those In Need Wwltv Com